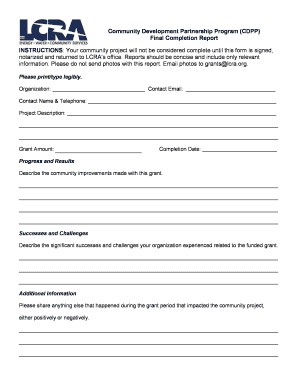

IRS 12508 1999 free printable template

Instructions and Help about IRS 12508

How to edit IRS 12508

How to fill out IRS 12508

About IRS 12 previous version

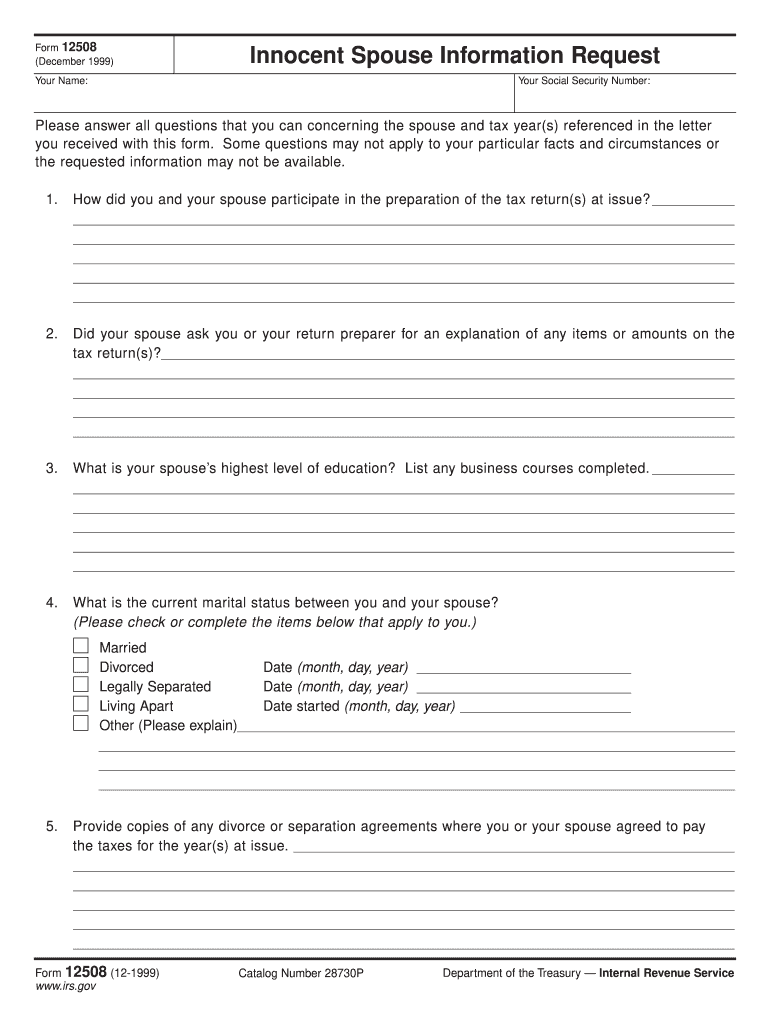

What is IRS 12508?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 12508

What should I do if I discover an error after submitting form 12508?

If you identify a mistake after your submission of form 12508, you can rectify it by filing an amended form. Ensure that you clearly mark it as an amended return, detailing the corrections made. This will help the tax authorities process your changes accurately and maintain compliance.

How can I check the status of my form 12508 after submission?

To verify the status of your submitted form 12508, you can use the online tracking system provided by the relevant tax authority. This system often allows you to monitor the processing stages and any issues that may arise with your submission. It's essential to keep your submission confirmation handy for quick access.

What should I do if my e-filed form 12508 gets rejected?

If your e-filed form 12508 is rejected, review the rejection codes provided to understand the reason for the rejection. Correct the identified issues and attempt to resubmit the form. Ensure to double-check the information for accuracy to avoid further complications.

Are there any specific requirements for e-signing form 12508?

When submitting form 12508 electronically, you must ensure that your e-signature meets the legal requirements set by tax authorities. This typically includes the use of a compliant electronic signature platform that provides proper authentication, ensuring the signature is both valid and secure.

How long should I retain records related to form 12508?

You should maintain records associated with form 12508 for a minimum of three years from the date of submission. This retention period is crucial for addressing any potential discrepancies, audits, or inquiries from tax authorities regarding your filing.