IRS 12508 1999 free printable template

Show details

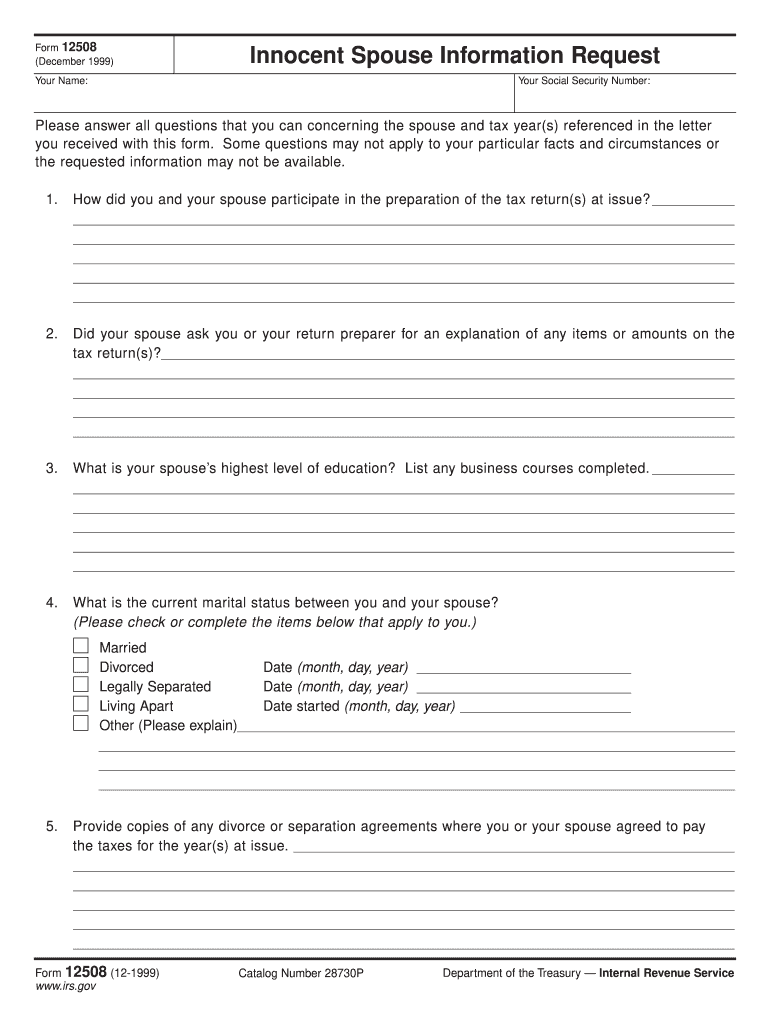

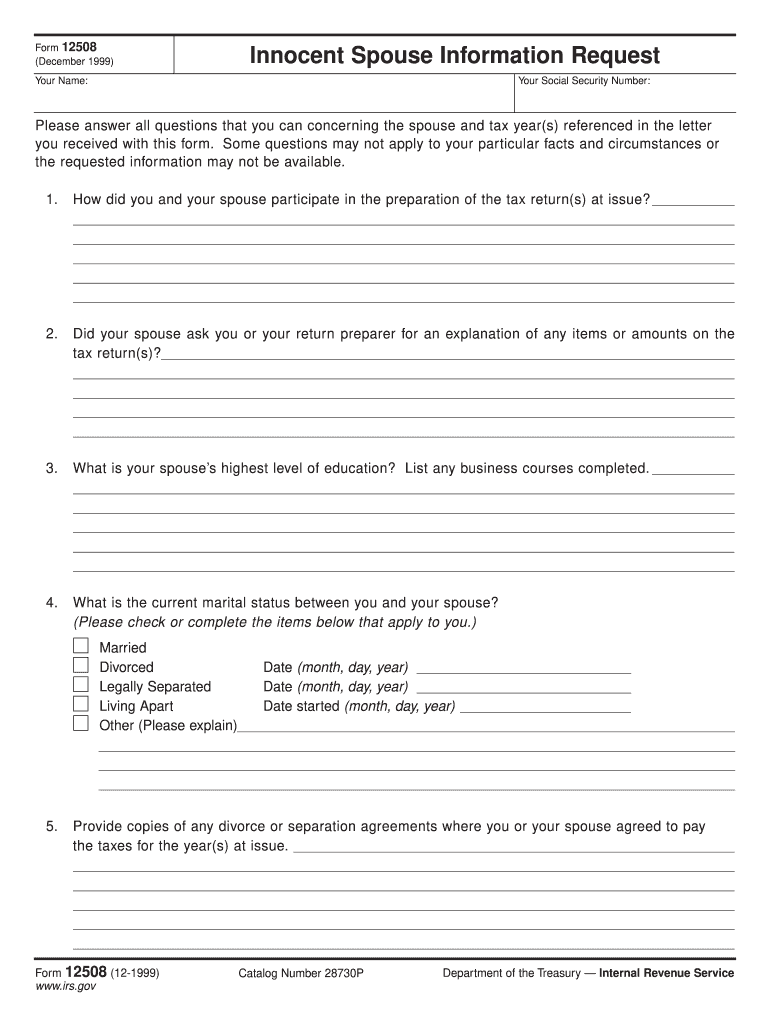

Form 12508 December 1999 Innocent Spouse Information Request Your Name Your Social Security Number Please answer all questions that you can concerning the spouse and tax year s referenced in the letter you received with this form. Some questions may not apply to your particular facts and circumstances or the requested information may not be available. How did you and your spouse participate in the preparation of the tax return s at issue Did your...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your form 12508 1999 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 12508 1999 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 12508 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form 12508. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

IRS 12508 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 12508 1999

How to fill out form 12508:

01

Gather all the necessary information and documents required to complete form 12508. This may include personal details, financial information, and any supporting documentation.

02

Carefully read the instructions provided with the form to ensure you understand the requirements and any specific guidelines for filling it out.

03

Begin filling out the form by entering your personal information accurately and legibly. This may include your name, address, contact information, and other relevant details as requested.

04

Follow the instructions on the form to provide any required financial information. This may involve disclosing your income, assets, liabilities, and other financial details as necessary.

05

If there are additional sections or questions on the form, answer them accordingly, making sure to provide all the requested information. Use additional pages if needed, ensuring you clearly indicate which section or question you are addressing.

06

Double-check all the information you have provided to ensure accuracy and completeness. Review the form for any errors or missing information, as these could delay the processing or approval of your submission.

07

Sign and date the form in the designated section, acknowledging that all the information you have provided is true and accurate to the best of your knowledge.

Who needs form 12508:

01

Individuals or businesses who are required by law or regulation to submit this specific form. The exact requirements for needing form 12508 may vary depending on the jurisdiction or specific circumstances.

02

Form 12508 may be necessary for individuals or businesses involved in certain financial transactions, tax reporting, or compliance requirements. It may also be required for individuals or businesses seeking certain benefits, permits, licenses, or authorizations.

03

It is important to consult the relevant authorities, legal counsel, or specific regulations to determine if form 12508 is required in your particular situation. Failure to comply with the necessary forms and requirements may result in penalties, fines, or other legal consequences.

Fill form : Try Risk Free

People Also Ask about form 12508

Where does 8949 go on 1040?

How do I write an irs disagreement letter?

What is form 12508?

What is IRS form 12508?

What is the irs direct deposit authorization form?

What is the IRS direct deposit authorization form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 12508?

Form 12508 is a document used by the Internal Revenue Service (IRS) in the United States. This specific form is titled "Model VCP Compliance Statement," and it is used in the Voluntary Correction Program (VCP) for retirement plans. The VCP allows plan sponsors to voluntarily correct any operational or documentation failures in their retirement plans and receive approval from the IRS. Form 12508 is one of the forms required to be completed and submitted as part of the VCP process.

Who is required to file form 12508?

Form 12508 is not a standard form used by the Internal Revenue Service (IRS) or any other government agency. Therefore, there is nobody required to file this form. It is possible that Form 12508 is specific to a certain organization or institution, but without further information, it is not possible to determine who would be required to file it.

What is the purpose of form 12508?

Form 12508 is used to request a refund of an overpayment of tax made to the Internal Revenue Service (IRS). This form is specifically used for the tax year 2020 or a subsequent year. Taxpayers can fill out this form to claim a refund of taxes paid in excess, either due to an error or because they overpaid their tax liability. The purpose of this form is to initiate the process of securing a refund from the IRS.

What information must be reported on form 12508?

Form 12508, also known as the Tax Information Request for Tax-Exempt Bonds, is used by tax-exempt bond issuers to request certain information from governmental units, private entities or individuals, or other entities that are required to report information about the use and expenditure of tax-exempt bond proceeds.

The specific information that must be reported on Form 12508 includes:

1. Identification information: The form requires general identification details of the party providing the information, such as the name, address, and taxpayer identification number.

2. Bond issue information: The form asks for specific details about the bond issue, such as the issue date, the bond issuer, and the purpose of the bond proceeds.

3. Expenditure information: The form requires reporting on the expenditure of bond proceeds, including the purpose of the expenditure, the amount expended, and the date of expenditure.

4. Compliance information: The form includes questions regarding compliance with federal tax laws and regulations related to tax-exempt bond use, such as whether the bond proceeds were used for qualified purposes and whether any private business use occurred.

5. Arbitrage compliance: The form includes questions related to compliance with arbitrage rules, which govern the investment of tax-exempt bond proceeds to ensure they are not used for arbitrage purposes.

6. Yield restriction compliance: The form requires reporting on compliance with yield restriction requirements, which limit the investment yield earned on tax-exempt bond proceeds.

It is important to note that the specific reporting requirements may vary depending on the type of tax-exempt bond issued and the purpose for which the proceeds are used. The Internal Revenue Service (IRS) provides detailed instructions for completing Form 12508, which can be referenced for additional guidance.

What is the penalty for the late filing of form 12508?

Form 12508 does not exist in the Internal Revenue Service (IRS) tax forms. Therefore, there is no specific penalty for the late filing of this form. It is important to provide accurate and complete information when asking about penalties for late filing so that the response can be more specific.

How do I modify my form 12508 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign irs form 12508 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out the instructions for form 12508 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign irs form 12508 instructions. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out irs gov form 12508 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your tax form 12508. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your form 12508 1999 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Form 12508 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.